January Strategy Summary

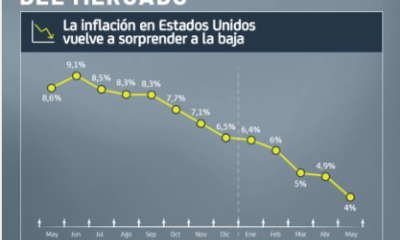

The latest growth data from the world’s major economies continue to show disadvantages, so fears of a more evident waning of the global economy still remain a major concern. Though, more expansive monetary policies from the world’s most influential central banks, and greater stimulus from the Chinese government, makes us maintain a neutral position between Fixed Income and Equity. Moreover, uncertainty in trade matters reinforces our cautious position.

During this month, we made no major changes to our strategy, so in equity we continue to prefer emerging markets over developed ones, with Latin America and the United States being our favorites.

Within global fixed income, we reduced exposure to High Yield in order to reduce portfolio risk, while in Investment Grade we increased exposure. Thus, both assets are placed in a neutral position.

Within Latin America, relatively speaking, we favor Brazil and Colombia, the former among greater optimism regarding the pension reform, and Colombia due to macro perspectives that continue to be positive, so in the latter we moved to an OW position. In Peru, we have reduced our exposure to a UW, since good prospects are already incorporated into prices, while in Chile, we maintain a neutral position, as we believe there has been an over-reaction in the market so far this year, so this is why we see room for some stability in the short term.