SURA Asset Management Uruguay come to an agreement with BlackRock, the world’s largest fund manager

The alliance will allow SURA Asset Management Uruguay to enhance its current value proposition in the country and to offer services that are more personalized.

Montevideo, Uruguay, October 24, 2016. In a breakfast event organized by Broker SURA Uruguay for its clients, the company presented the new services that it will offer in Uruguay after coming to an agreement of distribution of funds the US firm BlackRock.

The BlackRock director of Distribution of the wealth segment for Latin America and Iberia, Iván Pascual, pointed out the importance of placing their bet on a growing market through an alliance that enhances the current value proposition of SURA Asset Management Uruguay. In that regard, he indicated that the agreement between SURA Broker and BlackRock aims to offer a wide range of products that will enhance its current value proposition.

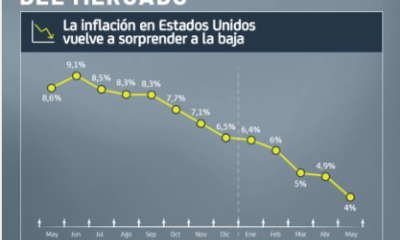

Additionally, Axel Christensen, BlackRock's Capital Markets Strategy for Latin America and Iberia, spoke about the company’s vision regarding global economic growth and inflation, as well as the way central banks are responding to it. During his presentation, he mentioned the political situation the United States is going through, and the situation of interest rates in that country. Finally, he addressed the risks in different scenarios from the standpoint of the BlackRock Investment Institute, which is the company’s center of markets excellence.

Authorities from both companies attended the presentation, from which the highlights were the participations of the executive president of SURA Asset Management Latin America, Ignacio Calle, the CEO of SURA Asset Management Uruguay, Gonzalo Falcone, the General Manager of Broker SURA, Gerardo Ameigenda and the BlackRock director of Distribution of the wealth segment for Latin America, Iván Pascual.

About SURA Asset Management

SURA Asset Management is a Latin American company with operations in the areas of Pensions, Savings and Investment in Mexico, Peru, Chile, Colombia, Uruguay and El Salvador. It is a subsidiary of Grupo SURA, in addition to having four other shareholders holding a minority stake: Grupo Bolívar, Corporación Financiera Internacional (IFC), member of the Grupo del Banco Mundial, Bancolombia and Grupo Wiese. As of June 2016, SURA Asset Management has a total of USD 111.3 billion in managed assets, belonging to 17.7 million clients.

* Customers and AUM include AFP Protección in Colombia and AFP Crecer in El Salvador, although not controlled companies, SURA AM has a significant stake.

About SURA Asset Management Uruguay

SURA Asset Management Uruguay manages different lines of business, among which the following stand out: AFAP SURA, the number two pension funds administrator in number of affiliates and funds managed in Uruguay; AFISA SURA, an Investment Funds administrator with public offering open funds authorized by the Central Bank of Uruguay; and SURA Broker, which provides investment solutions tailored to particular financial needs and objectives, offering access to a wide range of investment instruments.

About BlackRock

Blackrock is the leader in the management of investments, risks and advisory services for institutional and wealth clients around theworld. As of September 30, 2016, assets under BlackRock’s administration amounted to $5.1 trillion dollars. BlackRock helps its customers around the world meet their goals and overcome challenges, offering a range of products that includes the use of separate accounts, mutual funds, iShares® (marketable funds on the stock exchange), and other combined investment vehicles. BlackRock also offers risk management, consulting services and services for business investment systems for a broad base of institutional investors through BlackRock Solutions®. As of September 30, 2016, the firm had approximately 13,000 employees in over 30 countries and a prominent presence in global markets, including North America, South America, Europe, Asia, Australia, the Middle East and Africa. For additional information, visit the company’s website at.

www.blackrock.com/latamiberia.com | Twitter: @blackrock_news| Blog: www.blackrockblog.com | LinkedIn: www.linkedin.com/company/blackrock